identify the conditions to be satisfied and documents to be filed to claim the refund in different circumstances.explain the time limit for claiming refund and concept of ‘relevant date’ to calculate such time limit.identify the situations leading to refund claim.Documents required for GST Registration.Tax Invoice, Debit Note & Credit Note in GST.How scam and bill treading happen in GST.Rule 86B Restriction on use of electronic credit ledger.Rule 86A Condition of use of electronic credit ledger.List of sections and rules related to ITC.Sec 19 ITC on input or capital goods on goods send for Job work.Sec 18(6) Supply of capital goods or plant and machinery.

Sec 18(1)(d) ITC availment from exempt to taxable supply.Sec 18(1)(c) ITC availment from composite levy to regular.Sec 18(1)(b) ITC availment in case of voluntarily registration.Sec 18(1)(a) ITC availment in case of mandatory registration.Rule 42 apportionment of input & input services.Clause (aa) of sec 16(1) added by FA 2021.Sec 16 Eligibility & Conditions for ITC.

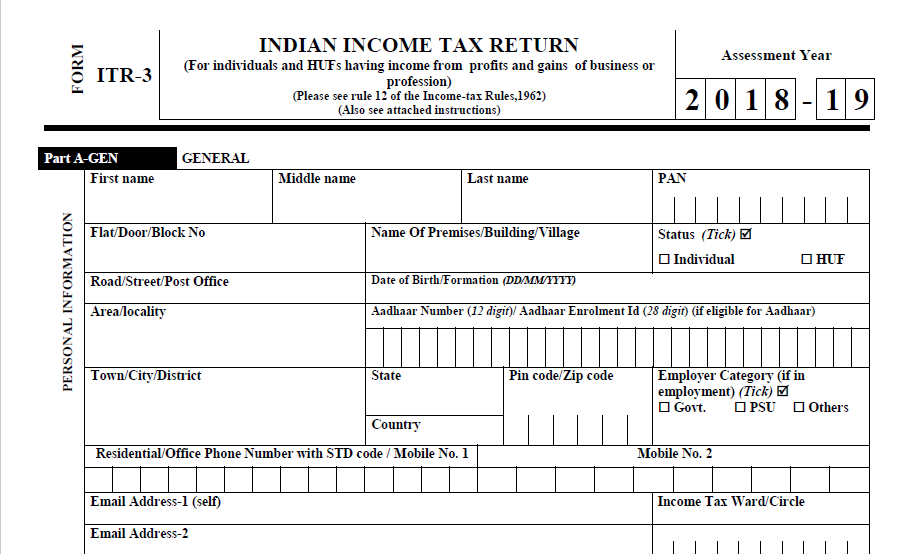

Learners will also get the Notes, PDF and Excel sheets along with informative videos. This is the Practical Course in GST, ITR & TDS where learners will understand the Provisions, Rules, Updates, Amendments, Budget 2023, Computations and Practical Filing of GST returns. This Practical Course in GST, ITR & TDS is designed keeping in view to upgrade the analytics and practical skills in GST. The nitty-gritties of GST and Income Tax with its inherent dynamism, makes the learning, understanding, practical application and analysis of the provisions of GST in problem solving very interesting and challenging.

0 kommentar(er)

0 kommentar(er)